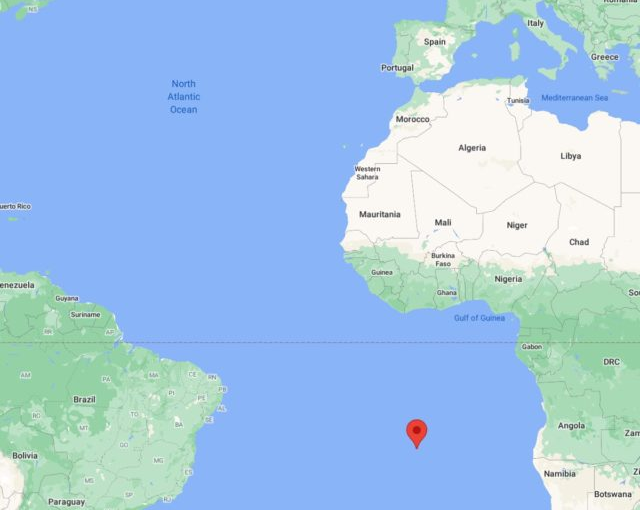

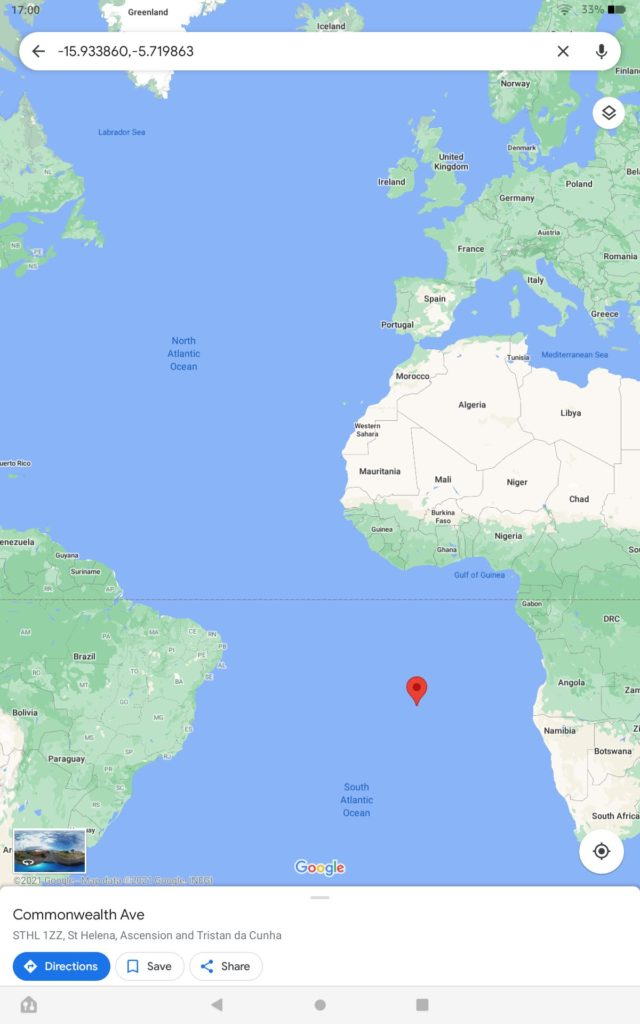

St Helena, on the South Atlantic, where I was working last year (2021) has vague notions that it can become a crypto centre. It will have fast internet connections working within a year. Here are my ramblings:

I suppose St Helena could offer is a legislative framework to support some innovation. It might be able to offer safe haven for storage of data.

St Helena seems to be wondering about solutions for Africans without bank accounts. This is being tried elsewhere; I have a tiny amount invested in a crypto company that is trying to develop a modern version of M-Pesa in Indonesia, where 90% of its huge population did not have bank accounts. M-Pesa and similar African schemes transfer money between people and their mobile phone accounts. They are successful because simple and intuitive. Any new solution must be better, ergonomic, simples. These African based phone companies must be trusted and in effect become on-line banks, so need to be licensed and regulated as such. A crypto, distributed ledger is in theory safer and no need to find a “safe” trusted third party. A Government could steal or nationalise M-Pesa, or even its system could be hacked. That’s still impossible with a distributed ledger.

The distributed ledger is an exciting solution said to be seeking a problem. The one cited problem has been cost of financial transactions between people, the cost of selling a house, all because the current systems have been built of over centuries to create trust. The distributed encrypted ledger should be able to cut out all middlemen, lawyers, brokers and even banks. The ledger machines throughout the world have to agree that a transaction is genuine and correct. It is a public record. Anyone can look up a Bitcoin address for example and see the transactions on that address. The land registry could be such a ledger, same for car ownership.

The distributed ledger is not instantaneous as it is limited by the speed of light, or rather by the latency of internet cables, and the speed of the computers holding the distributed ledgers. It could not be easily used for high speed trading. St Helena, even with the new cable connection will suffer from a little longer ping time, longer latency, than servers within Europe, USA and Asia so this may limit St Helena’s use on the crypto scene.

There is an idea that perhaps the world should put precious data on the moon to keep out it of harm’s way. St Helena could offer that safety on earth, but it would need power sources other than diesel to run any kind of servers, including any “mining” or distributed ledgers

People worry this is all crypto is all speculation, a ponzi scheme. Bitcoin has no intrinsic value. The value is only a perception of what it is worth, as others agree. But paper fiat money is the exactly the same; the paper is worth nothing, yet we all intuitively agreed on value of a £20 note (until inflation hits). Governments have been printing fiat money, banks creating it (they lend more than their deposits) for decades, and it got worse with Covid, so its no wonder we now have inflation, principally of capital (houses) making the rich richer, but now inflation is at risk of running away. The advantage of Bitcoin is the number of coins is limited to 21 million of them, the hard cap. We would have expected Bitcoin to gain in strength as inflation hits. But it collapsed as too many were speculating using borrowed money and too fancy schemes linked to other asset classes. This will wash out.

Attempts to create stable coins are fraught, as to peg say a tether $ would mean Tether would have to hold a fiat $ to every tether $ electronic coin. But it never did, so acted like a bank creating more Tethers than it held. Bringing back the principle of the need to trust someone, and thus acting like a bank. There are many mathematical attempts to resolve this dilemma to establish more stable coins, but recently those algorithms failed spectacularly (Terra USD)

Governments flirt with the idea of creating their own crypto coins. They would be stable, hard linked to their fiat. Coins and paper would cease to exist. They could mint more coins, have total control over money supply. This would seemingly abolish banks being involved in transactions, people would no longer need bank accounts. All money electronic. This of course is a communist idea of absolute control over the population. Tax impossible to avoid, all spending monitored by Government. Since Banks would no longer hold deposits where would any lending come from? The Government.

I am not sure I can see how St Helena can fit into this revolution as yet.

Dr Gerry Bulger ex SMO St Helena